🏡 Wealth-Building Strategies in Real Estate: 4 Proven Paths

🏡 Wealth-Building Strategies in Real Estate: 4 Proven Paths

Real estate remains one of the most powerful ways to build long-term wealth. Whether you’re an individual investor or a commercial real estate professional, there are multiple strategies to grow income, diversify your portfolio, and create generational wealth. Let’s explore four of the most popular approaches:

1️⃣ Building a Rental Property Portfolio

Owning rental properties is one of the most reliable ways to generate steady, passive income.

Residential rentals (single-family homes, condos, small multi-units) build consistent cash flow.

Commercial rentals (office, retail, industrial) often come with longer leases and higher returns.

✅ Pro tip: Successful investors scale by reinvesting profits into more properties, creating a snowball effect over time.

2️⃣ Fix-and-Flip Ventures

The “buy, renovate, sell” model remains attractive for those who want shorter-term gains.

Look for undervalued properties in up-and-coming neighborhoods.

Renovate strategically to maximize resale value without overcapitalizing.

Sell quickly to reinvest in your next project.

✅ Pro tip: Timing is everything—market cycles and demand trends play a big role in profitability.

3️⃣ Commercial Real Estate Opportunities

Commercial real estate (CRE) offers investors a chance to play big:

Office space in high-demand metros.

Retail centers in strong consumer markets.

Industrial warehouses & logistics hubs driven by e-commerce.

Hospitality & short-stay ventures that adapt to tourism and travel trends.

✅ Pro tip: CRE can deliver strong returns, but requires market research and tenant management to succeed.

4️⃣ Real Estate Syndication

For investors who don’t want to go it alone, syndication opens doors to larger deals.

Multiple investors pool funds to acquire big assets (like apartment complexes or hotels).

Managed by a syndicator or sponsor, making it more passive for limited partners.

Offers diversification and access to high-value properties otherwise out of reach.

✅ Pro tip: Review syndicator track records carefully before committing.

🚀 Why The Property Market Matters

No matter which wealth-building strategy you choose, success starts with finding the right property.

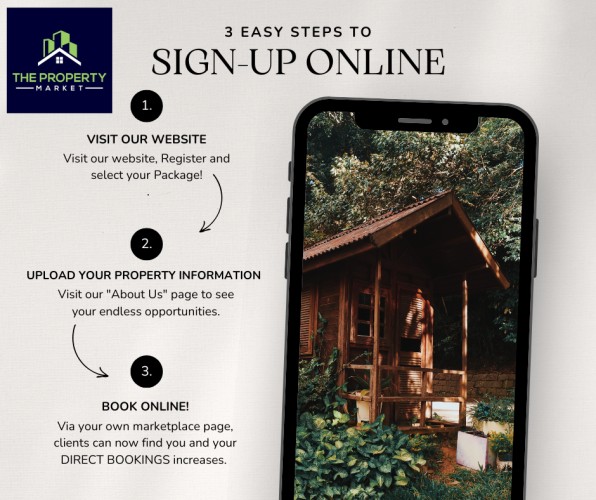

That’s where The Property Market comes in:

Discover rentals, flips, and CRE listings all in one place.

Connect with trusted agents & investors actively looking to buy, sell, or partner.

Advertise your listings to a global audience of serious investors.

🌟 Final Takeaway

Wealth in real estate is built on strategy, timing, and access to the right opportunities. Whether you’re stacking rentals, flipping for fast profits, diving into commercial assets, or joining a syndication, the path to financial growth is wide open.

📍 Start your journey today on The Property Market. Visit our social media platforms for more...